Recently, the U.S. government released its updated 2025 Critical Minerals List, naming niobium as the second most critical mineral for national security.https://metals-tech.com.br/wp-content/uploads/2025/11/Niobium-as-critical.avif

Niobium’s role in technology, energy, aerospace, and defense has drawn increasing attention , not only for its strategic value but also because of its extreme geographic concentration. With Brazil supplying over 90,9% of global production, any operational or political disruption could send shockwaves across multiple industries and supply chains worldwide.https://metals-tech.com.br/wp-content/uploads/2025/11/critical-minerals.webp

China’s Quiet Consolidation of the Niobium Value Chain

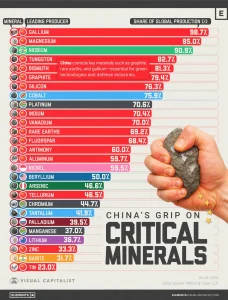

While public debate often focuses on lithium or rare earths, China has been building its influence in niobium for more than a decade through strategic acquisitions and minority stakes that now span nearly the entire global supply base.

- 2011: A five-company Chinese consortium (CITIC, Baosteel, Anshan, Shougang, and TISCO) acquired 15% of CBMM, the world’s largest niobium producer.

- 2015: IAMGOLD sold the Niobec mine (Canada) to a group backed by CEF Holdings (Hong Kong) and Temasek (Singapore).

- 2016: Anglo American sold its niobium operations in Brazil to China Molybdenum (CMOC), creating the world’s second-largest producer.

- 2024: Minsur (Peru) agreed to sell Mineração Taboca (Brazil) to China Nonferrous Metal Mining Group (CNMC), further expanding Chinese ownership in upstream critical metals.

At the same time, China is developing its own niobium production capacity, sourcing concentrates from Africa (notably Nigeria) and Brazil, moving toward a more integrated and self-sufficient supply chain.

Together, these moves have quietly reshaped control of one of the world’s most strategic resources, leaving the U.S. and its allies more exposed than many realize.

A Market on the Verge of Disruption

In my view, the niobium market is entering a period of transition.

Several new projects have been announced ,not all will reach production, but collectively they will reshape global supply dynamics.

Emerging players include:

WA1 Resources (Australia), Encounter Resources (Australia), St George Mining (Brazil), Summit (Brazil), Power Minerals (Brazil), Globe Metals & Mining (Malawi), NioBay Metals (Canada), NioCorp (USA), and Capacitor Metals (Canada).

Beyond mining, innovative startups are also entering the space, using tailings and secondary feedstocks to produce niobium through new processing technologies now moving from pilot to market-ready phase.

Regionalization and New Offtake Strategies

The next few years will likely bring a more regionalized niobium market.

- The U.S. is actively seeking to develop domestic supply.

- Europe, recognizing its vulnerability, will pursue long-term offtake agreements with emerging producers in Australia and Africa.

This is just a short commentary , but one that highlights how niobium’s geopolitical landscape is changing faster than most realize. What has long been a stable, Brazil-centered market is now fragmenting under new pressures, technologies, and strategic interests, and the consequences will be global.